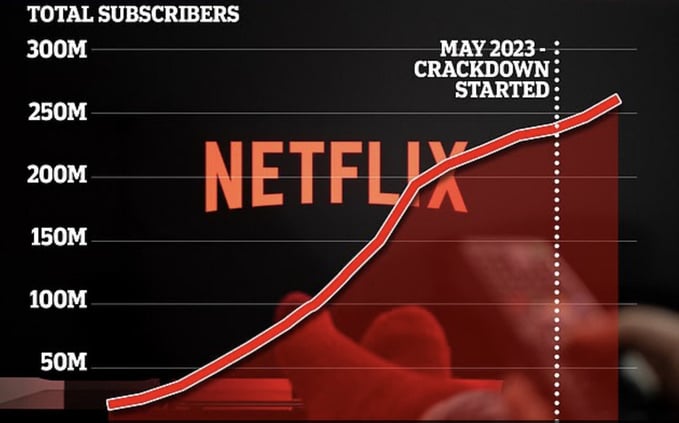

Netflix’s Q4 2023 figures were much better than even the more optimistic analysts thought they would be. The streamer is now comfortably the world’s biggest. It added 13.1 million subscribers in the three months that ended in December. That made the period its biggest Q4 ever and was the most new quarterly users seen since the lockdown-fuelled pandemic boom in 2020.

It now has a total of 260.8m subscribers, with analysis of the figures suggesting that many of those using a shared password have switched to the cheapest ad-tier service.

It now has a figure of over 277 million, and the latest figures mean that it has managed to add 50 million subscribers since it first implemented its password-sharing crackdown. This is way in advance of its own predictions.

“We believe we've successfully addressed account sharing, ensuring that when people enjoy Netflix they pay for the service too,” it commented in an earnings statement earlier this year. “Features like Transfer Profile and Extra Member were much requested, and many millions of our members are now taking advantage of them. At this stage, paid sharing is our normal course of business.”

It is worth remembering that in 2022 when Netflix started its password-sharing crackdown, it estimated that 100 million accounts were sharing passwords with people outside their households, 30 million in the US alone.

A pivot to paid sharing

Netflix’s move to crackdown on password-sharing has been a big success for the company. Many analysts thought the company might indeed monetize 30m subscribers, but there would be an initial backlash in 2023, with real success not coming until the end of 2024.

The following graph shows a pronounced uptick as soon as the crackdown was implemented.

Source: thisismoney. NB: May 2023 was when the crackdown started in the US

It is also interesting to note the psychology at work here. Netflix accentuates the positive, referring to the move as ‘paid sharing’. It provides users with a positive service that enhances their streaming consumption rather than a negative punishment curtailing it. It is also not a one-time initiative but rather a new core plank of the company’s business strategy.

Given the success of the move, it is unsurprising to see other streamers replicating the Netflix move.

Disney-owned streaming services are the next high-profile providers to take action. A Hulu and Disney+ password crackdown has now started in the US after several delays.

An update to the Hulu user agreement at the end of January stated that users “may not share your subscription outside of your household” and that the company reserved the right to determine compliance with the new rules. Similar language appeared in subscriber agreements for Disney+ and ESPN+. And Disney will be hoping for similar success and subscriber growth to Netflix for its services too.

“Your Disney+ subscription is meant to be used within your Household, which is a collection of devices associated with your primary personal residence that are used by the individuals who reside there,” the company explains in a message to customers. Anyone residing outside the household of a Disney+ customer “will need to sign up and pay for their own subscription or be added as an Extra Member to your account for an additional monthly fee to continue enjoying Disney+.”

A holistic strategy

Of course, simply establishing paid sharing on its own is only part of the story. Alongside that core strategy, Disney and Netflix have both carefully established tiered services that provide a friction-free way for users to transition to their own accounts. A variety of discounts and special offers are available for those who follow the nudge warnings, aiming to make the transition as seamless as possible.

Operators looking to replicate the strategy will need to make similar moves. As with all things to do with digital piracy, one of the easiest and most effective strategies is to ensure that you make it easy for consumers ‘to do the right thing.’ Make it simple, easy, and cost-effective, and with luck, many of the shared accounts will disappear.

Beyond that, there is a requirement to detect password-sharing that can trigger further warnings to users. This should take place as part of a comprehensive overall anti-piracy strategy and involves sophisticated routines and AI analysis to examine data concerning IP addresses, device IDs, and account activity to determine whether a device signed in to an account is part of the same household.

A quick Google search will show many websites hosting advice on how users can avoid password-sharing detection, so it is essential to use the latest AI-based tools for pattern recognition analysis coupled with human expertise on the subject.

It is also important to make this an ongoing strategy. As Netflix co-CEO, Greg Peters, commented: “We’re excited to be at the point where we’ve operationalized that paid- sharing product work. It’s integrated into everything we do, and we are iterating and improving on it just like we would any other significant part of our product experience,”

The need for ROI

After a period of growth where credentials sharing was tolerated by many to widen the base, even if those subscribers were not monetized, streaming services need to make money in 2024. Investors in companies such as Netflix and Disney demand profitability, and profitability is vital whatever the size of a streaming company.

When Netflix estimated that 100m accounts were sharing credentials outside their households, it had 222 million subscribers. While it would be a big stretch to suggest that a similar 45% of every streaming service is doing the same, there is money that every streaming service not implementing and enforcing paid sharing is leaving on the table.