As more and more operators look towards including advertising revenue into their business models, so the importance of AI to the future of targeted advertising is becoming clear.

One of the meta trends in the industry at the moment is that television business models are becoming increasingly hybridised. The world a decade or so ago was still very binary. On the one hand you had free television, typically ad-funded and also sometimes via supported by a license fee model, but essentially free at the point of consumption. Then you had the Pay-TV model where the consumer paid for the service, and there was a clear and distinct different between them.

Now though the lines are blurring.

Pay-TV operators with inventories are looking to diversify their revenues and launch new services to mitigate against revenue stagnation, and are increasingly looking at maximising the ad-funded component of their business models via addressable advertising. Pay-TV operators without inventories still have assets, access to data, and insertion capabilities, and also can benefit from addressable’s potential.

Meanwhile at the other end of the spectrum, the free to air broadcasters are looking to maximise their own assets by offering premium services to their customers; offering advanced functionality via online players, box sets, first run exclusives and the like.

And then you have a third component to this: the ‘green field’ players, the new OTT service providers, some of whom are already moving from their previous position as a pure subscription service towards offering AVOD-driven services as a way of mitigating against rising acquisition costs.

Looking for patterns

We’ll come back to the macro picture in a moment, but for now let’s concentrate on the micro and look at the acquisition of data and the way that operators can leverage it which, currently, is definitely under exploited in the industry.

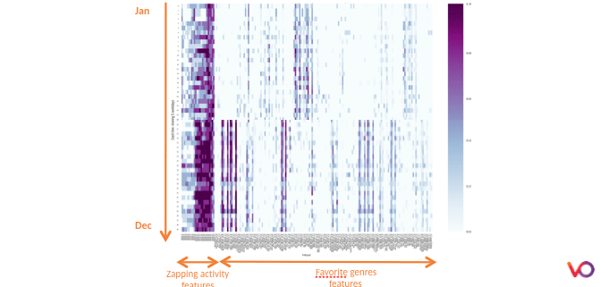

What you see in the graph below is the way that our data scientists visualise the data from a single viewing household. The vertical line is time, with each of the 52 lines representing a single week, the horizontal line represents the features of the data: zapping activity and what genres are being consumed. This gives you a viewing profile of a household.

Where it gets really interesting is when you apply AI techniques to this comparatively raw data. This enables you to extract all sorts of information from it starting from user segmentation.

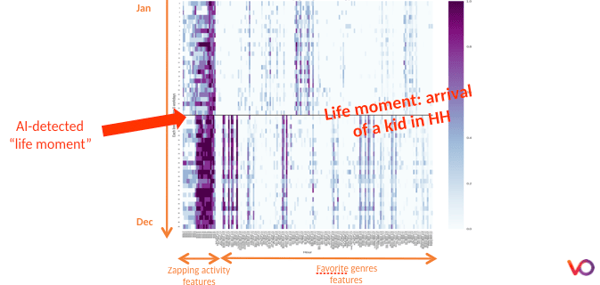

Have a look at the graph below where our AI has drawn a line across the middle of the data. What it is detecting is what we call in the jargon a ‘life moment’. This highlights the fact that there is a change in viewing behaviour between the first half of the year and the second half; the genres that are being watched and the viewing activity are both changing with much more peak time content being viewed. This example represents the arrival of a child in the household.

It’s a fairly extreme example and the change in viewing pattern is fairly easily detected, but it illustrates the power of AI to provide granular household segmentation from ‘passive’ monitoring of viewer data. More complex techniques, such as deploying neural networks, can lift more complex segmentations from the data and identify when people have retired, for instance.

In looking to launch an addressable advertising service, operators will traditionally use two types of data: first party data or third party data.

First party data is typically collected by the service provider. It is high quality but has limited scope as it only concerned the customers of the service provider and how they interact with it. Third party data is sold by brokers and covers a wide variety of subjects and is used to supplement the first party data and provide greater nuance to the segmenting process.

The arrival of the GDPR has changed the economics of this, however, and made the inclusion of that third party data problematic. How do you ascertain that the data provided by a chain of intermediaries has been collected in a compliant way? It is difficult to do and, where it is done, has substantially raised its costs.

This is where AI techniques come in. They do not provide deterministic data they provide probabilistic data, but it is constantly up to date and constantly being refined as the AI routines sift and analyse their way through the vast amount of TV viewing data that operators are collecting.

Increasing targeted advertising revenue

Linking this all together, back up at the macro scale AI can help accelerate the hybridisation of TV business models we are seeing.

When it comes to improving advertising revenues, you can decrease third party and compliance costs while improving CPM by the sheer fact of it becoming targeted CPM. You can also increase the number of impressions as better personalised TV leads to increased TV usage. All of which makes addressable advertising-driven models seem increasingly more attractive (and there has been plenty of research that shows that consumer push-back doesn’t kick in immediately - see our blog post Why AVOD Solutions Are Becoming Increasingly Attractive for more details).

AI has multiple impacts elsewhere too. Pay-TV costs are growing; content is becoming more expensive and cord cutting and cord shaving are all having impacts while revenues are plateauing. If you apply AI to this part of the industry you can start to spot the customers that are about to churn and apply mitigation techniques on the one hand and on the other identify the assets — from entire packages of services to individual movies — that can be potentially upsold to individual consumers. You can also use segmentation to identify consumers that may be more amenable to convert from a freemium model to a full subscription.

The future service provider

The net result of all this is that we are starting to see a new breed of service provider that is wanting to leverage the commonalities between the two different models, the advertising-funded and the Pay-TV. The blueprint of the small hybrid service provider of the future is one where service providers can opt for increasingly holistic TV monetisation strategies and the overall workflow accommodates both.

This future is not that far away either. Just before IBC we made an announcement about a new end-to-end programmatic ad solution with our new partner, Smart Adserver, meaning that operators can now monetise their audience segments throughout the programmatic chain. This uses behavioural insights on TV-usage data provided by our AI research rather than relying on third party data sets, and is part of the wider movement in the industry that will help to increase the degree of blur of those increasingly outmoded lines between traditional Pay-TV models and ad-funded broadcasting.

Image by RichFL from Pixabay