Industry Insights: Netflix and Amazon introduce new engagement tools to enhance user experience, while sports streaming drives growth in the video streaming market, and new trends emerge from MIPCOM 2024.

Netflix and Amazon introduce new engagement tools

Two really interesting new methods of boosting viewer engagement have been unveiled recently, one from Netflix, one from Amazon.

Netflix Moments is a new feature on mobile (iOS now, Android to follow in a few weeks) that effectively allows users to save, rewatch, and crucially share their favorite scenes across Netflix titles. Users just tap the Moments button at the bottom of the screen, and the scene will automatically be saved to their My Netflix tab. Tap again and you can share across Instagram, Facebook, and other social platforms. This is very cool.

This set of activities was all rigorously blocked before now, leading to a thriving and unofficial industry of stan accounts swapping screenshots, videos, and memes across social. By taking control of it, Netflix gets another valuable insight into user behavior and yet more viewer data to analyze.

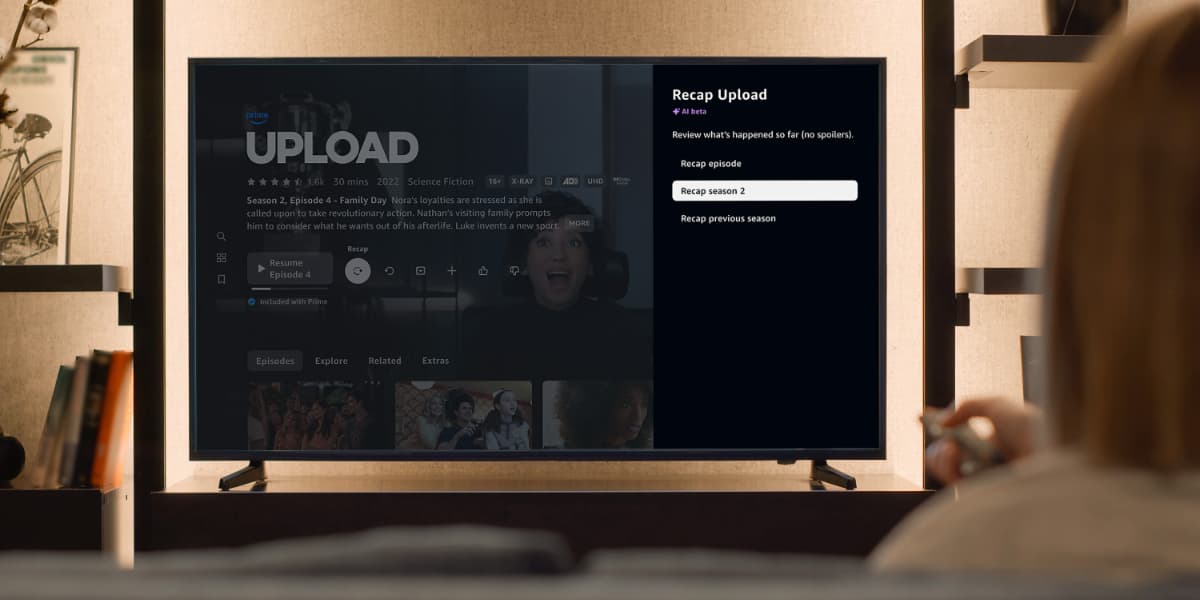

Amazon, meanwhile, is leaning into its increasingly powerful AI toolsets to provide summaries of full seasons of TV shows, single episodes, and even fragments of episodes, all personalized down to the exact minute viewers were watching.

Utilizing a combination of Amazon Bedrock models and custom AI models trained on Amazon SageMaker, the new feature is called X-Ray Recaps (pictured above). It analyzes various video segments, combined with subtitles or dialogue, to generate detailed descriptions of key events, places, times, and conversations. Guardrails are also applied to ensure the generation of spoiler-free and concise summaries.

It’s having a slow roll out to begin with, starting off in beta for Fire TV customers in the US, with support for additional devices coming by the end of the year. At launch, customers can use X-Ray Recaps on all Amazon MGM Studios Original series such as The Wheel of Time, and The Boys. One would imagine though that it will be rolled out fairly swiftly across increasing areas of the catalogue.

Key takeaways from MIPCOM 2024

The massive international content fair that is MIPCOM took place in Cannes towards the end of October. As ever it provided an important indication of the state of the industry, with the excellent Ampere Analysis The Amp newsletter providing some insightful analysis on the emerging trends.

It may be too soon for optimism, but perhaps the worst of the cost-cutting and stagnation of production spend is drawing to an end. The industry had to scale to meet peak TV demand during Covid and its immediate aftermath, and the readjustment back to normal levels has been brutal. In fact, the new normal may be characterized by slightly lower demand for a while. The production sector might have some further shrinkage to accommodate yet, but the very worst should be behind us. That is the hope at least.

New content is being made with activity in the Crime, Comedy, and Romance sectors. True Crime in particular is doing well, straddling as it does both the Drama and Documentary sectors. There is also increasing enthusiasm for the old-school procedural episodic drama, whether crime, medical or legal. This is accompanied by a return to the old linear television model of series comprised of self-contained episodes rather than story arcs that take an entire run to tell.

“This works well for longer-term customer retention because it keeps viewers coming back week after week rather than bingeing a season in 48 hours, and it works well for advertisers,” says Ampere.

Unscripted commissions are notably up for the streamers, driving the second-strongest three-quarter round of commissioning since the post-pandemic peak. Interestingly, more and more production is moving outside of the US, driven by a combination of tax incentives, lower costs, and the advantages of physically producing localized content in significant national markets. As the US market becomes saturated and growth moves overseas, so production follows.

Licensing is increasingly part of the mix too. Just before the pandemic, 60% of Netflix’s most popular shows were Originals; today, 60% are licensed. And as far as FAST goes, it still continues to grow; over a third of US homes now watch FAST platforms on a monthly basis and, between them, the US FAST channel market demands about 3000 hours of content a month. Much of that is licensed.

Sports fans drive streaming growth

Amongst a blizzard of data from the latest report on the global video streaming marketplace by Kantar, a data marketing and analytics specialist, it seems that sports is playing an important point in driving the growth of streaming audiences.

Driven in large part by the Summer Olympics, half of households surveyed (US, Australia, UK, Germany, Spain and France) watched sports, up from 44% in Q2. Some 56% of new viewers were female and 48% were aged 55+.

Understandably given the Games’ location, sports viewership was highest in France (57%), though it being lowest in the UK (41%) is a bit of a surprise. All in all, the Olympics accounted for one in four new discovery+ subscribers in Q3, making it one of the fastest-growing services in 2024 and highlighting the move away from linear TV. Sports viewers’ engagement is also interestingly high across related categories, with just over 20% regularly listening to podcasts to enrich their sports experience.

“Streamers are now using [sports] to cash in on new subscribers – sports fans are a highly engaged, valuable audience who exhibit stronger satisfaction and loyalty to their regular TV services,” commented Andrew Skerratt, Global Insights Director at Kantar. “However, succeeding in sports on demand requires more than content rights. Leading services must invest in high-quality delivery, top-tier commentators and interactive features to build a dedicated sports audience.”

Elsewhere, there was some other interesting data in the report:

- Among new users, 39% opted for SVOD, AVOD claimed 29%, FAST 24%, and vMVPD (virtual multichannel video programming distributor) services 8%.

- Apple TV+ and discovery+ were the fastest growing major multi-market VOD streamers year-on-year, with the Olympics playing a big role in discovery+ success in 2024.

- Prime Video had the highest share of paid VOD subscriptions in both Q2 and Q3.

- 26% of Apple TV+ users that have at least one other subscription ranked it as their most important service, up from 20% this time last year.

- Germany is the fastest-growing VOD market, with penetration increasing by 8 percentage points in the past two years. Local services are playing a big part in this.

Lastly, HBO’s House of the Dragon was the most enjoyed show by quite some distance and is cited as playing a significant role in the launch of Max in France. Behind this in the popularity stakes came The Boys on Prime Video and Bridgerton on Netflix.